National Minimum Wage and PRSI AX Changes

The national minimum wage in Ireland will increase from €9.80 to €10.10 per hour from 1 February 2020 for people aged 20 years and older. This will have an impact on both PRSI and USC.

PRSI will be impacted as follows:

- There will be no changes to the employee rates for PRSI.

- There will be no change to the employee PRSI credit.

- The PRSI employer threshold for class AX will change from €386 to €395 (weekly).

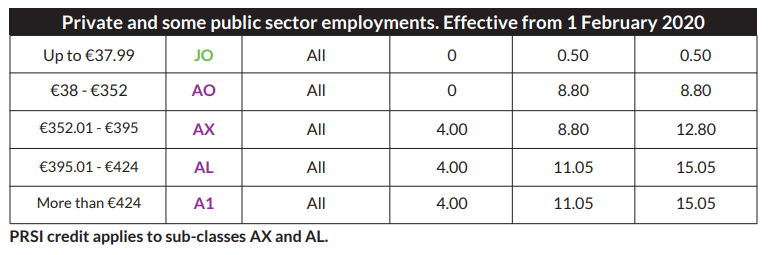

The PRSI contribution rates will therefore be as follows for private and some public sector employments:

As always, SimplePay takes the hassle out of Compliance for our users. We have already made updates to the system to ensure that the PRSI calculation is correct, depending on the date of your payslip. This means that if you prepare payslips that are dated before 1 February 2020, the system will use the previous thresholds, while payslips dated from 1 February 2020 will use the updated thresholds. There is therefore no need for you to make any changes or updates on your end – you simply continue capturing payroll as usual.

The USC threshold for the 2% bracket will also change so that full-time minimum wage workers stay in the same USC bracket. This change will be reflected through changes in employee RPNs and will take effect on 1 March 2020.

For more information on PRSI and USC, check out our help pages here.

Team SimplePay